SHOPPING FOR LIFE INSURANCE MADE EASIER FOR YOU

Canada's easiest way to compare life insurance quotes

No need to ask "how much is it?"

You tell us how much you want to pay, and we'll find the best coverage for you!

SHOPPING FOR LIFE INSURANCE MADE EASIER FOR YOU

Canada's easiest way to compare life insurance quotes

No need to ask "how much is it?"

You tell us how much you want to pay, and we'll find the best coverage for you!

The only broker in Canada to offer three different ways to get a Life Insurance quote

MULTI-PRODUCT QUOTE

Compares the prices of multiple types of Life Insurance products

More details

With this type of quote, you will enter the amount of insurance that you need, e.g.: $500,000, and the quoting tool will give you an output of the most to least competitive prices for each product type (Term 10, 15, 20, 25, 30 and Lifetime coverage).

For example:

$500,000 will cost you

Term 10: $23 - $38/mo

Term 20: $35 - $54/mo

Term 30: $52 - $78/mo

Best for those who:

Know how much coverage they need

Not sure about which product they need

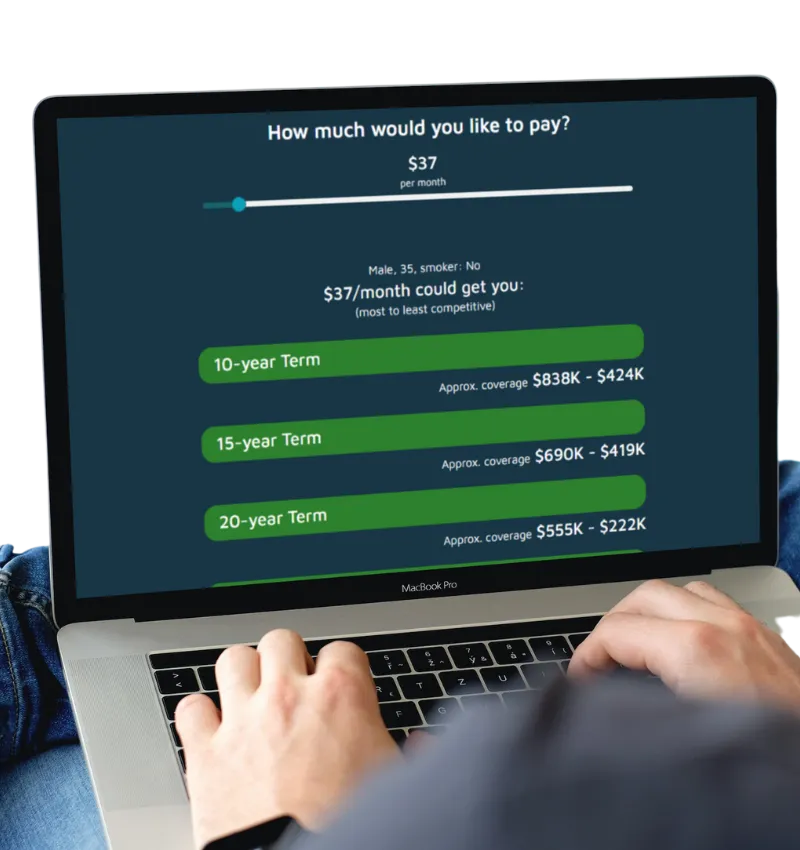

QUOTE BY PRICE

(most popular)

Tell us how much you want to pay and we'll give you coverage options across multiple companies!

More details

With this type of quote, you will enter an amount of premium that you would like to pay per month, e.g.: $50 per month, and the quoting tool will give you an output of the most to least amount of overage that you could get for each product type (Term 10, 15, 20, 25, 30 and Lifetime coverage)

For example:

$50/mo could get you in coverage

Term 10: $900,000 - $700,000

Term 20: $680,000 - $400,000

Term 30: $350,000 - $200,000

Best for those who:

Have a budget in mind

Not sure how much coverage they need

Not sure which type of life insurance they need

TRADITIONAL QUOTE

Compares the prices of a specific product across all insurance companies

More details

With this type of quote, you will have to choose the amount of coverage you need e.g.: $500,000 and the type of product that you are looking for e.g.: 20-year Term, and the output will be the price for that product for each available company.

For example:

$500,000 - Term 20

Company A: $23/month

Company B: $25/month

Company C: $28/month

Best for those who:

Know how much coverage they need

Know exactly which type of life insurance they need

The only broker in Canada to offer three different ways to get a Life Insurance Quote

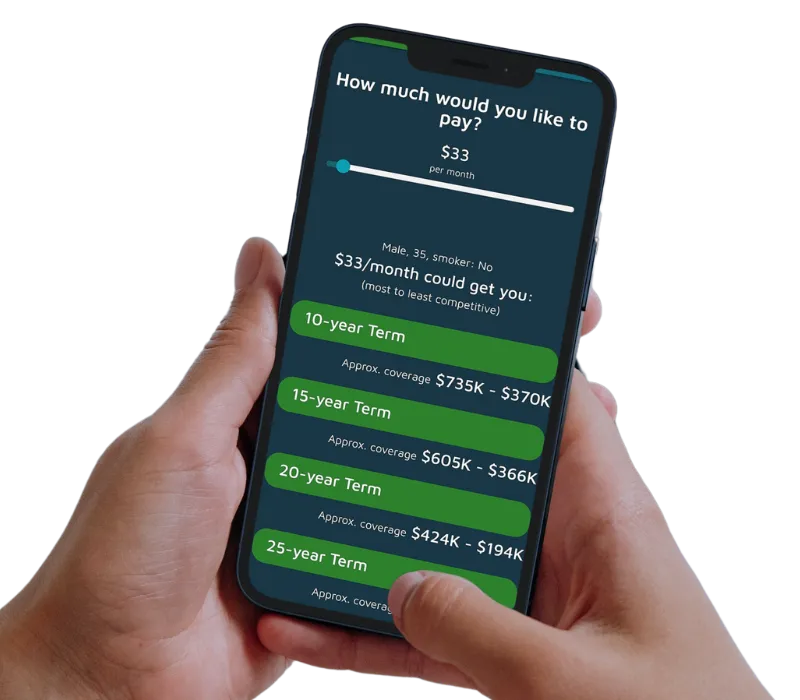

QUOTE BY PRICE

(most popular)

Tell us how much you want to pay and we'll give you coverage options across multiple companies!

More details

With this type of quote, you will enter an amount of premium that you would like to pay per month, e.g.: $50 per month, and the quoting tool will give you an output of the most to least amount of overage that you could get for each product type (Term 10, 15, 20, 25, 30 and Lifetime coverage)

For example:

$50/mo could get you in coverage

Term 10: $900,000 - $700,000

Term 20: $680,000 - $400,000

Term 30: $350,000 - $200,000

Best for those who:

Have a budget in mind

Not sure how much coverage they need

Not sure which type of life insurance they need

MULTI-PRODUCT QUOTE

Know how much coverage you need but aren't sure which product is best for you?

This quote will compare the price of multiple types of Life Insurance across several companies

More details

With this type of quote, you will enter the amount of insurance that you need, e.g.: $500,000, and the quoting tool will give you an output of the most to least competitive prices for each product type (Term 10, 15, 20, 25, 30 and Lifetime coverage).

For example:

$500,000 will cost you

Term 10: $23 - $38/mo

Term 20: $35 - $54/mo

Term 30: $52 - $78/mo

Best for those who:

Know how much coverage they need

Not sure which product they need

TRADITIONAL QUOTE

Know how much coverage you need but aren't sure which product is best for you?

This quote will compare the price of multiple types of Life Insurance across several companies

More details

With this type of quote, you will have to choose the amount of coverage you need e.g.: $500,000 and the type of product that you are looking for e.g.: 20-year Term, and the output will be the price for that product for each available company.

For example:

$500,000 - Term 20

Company A: $23/mo

Company B: $25/mo

Company C: $28/mo

Best for those who:

Know how much coverage they need

Know exactly which type of life insurance they need

We work with the best and strongest life insurance companies

We work with the best and strongest life insurance companies in Canada

ABOUT IRON TRUST FINANCIAL

Trusted advice and insurance solutions to protect you and your family

Our mission is to provide the best life insurance advice for our clients. We strive to provide a friendly professional service by putting our clients first.

Personal Approach

We strive to understand each client's specific needs without using a cookie-cutter approach

Expert Advice

Years of experience have made us experts in helping clients find the right solutions

Unbiased Recommendations

As a fully independent broker, we work for you, not the insurance companies

Your Privacy Matters

All consultations with us are always private and confidential. We do not sell or share your information, ever.

Easy to Reach

Whatever your needs are, we are always one phone call away, even after business hours

Fully Digitalized

We are equipped to fully serve you virtually and conduct all business paperless

WHY WORK WITH A BROKER?

Brokers work for you - insurance companies work for themselves

Insurance companies have one product to offer - their own.

Insurance brokers assess your specific needs and shop the market to find the best products available.

Brokers don't charge you for their services

You might think brokers cost more than working directly with an insurance company, but they don't. You'll pay the same rate for insurance with or without the advice and expertise of a broker.

Brokers have better access to what you need

Insurance brokers have pre-existing relationships with insurance companies and typically can get faster service and better access to what you need.

Testimonials

Pedro has been a valued financial advisor. I have known him to be an honest and reliable person who guides and provide information with significant knowledge. I appreciate the time he has spent answering my questions. Best wishes for success!

-Martha S.

Pedro has been doing this for a long time and is dedicated to his clients. Something I wasn't experiencing from other financial advisors. I recommend him to as many people as I can because of this. He is one of the few advisors that will explain everything and give you options without feeling pressured or having regret. Definitely a great person to deal with!

-David C.

Pedro was very helpful and diligent in our process of getting our first life insurance. He answered all our questions and guide us to get the best option. I am sure this won’t be the last time we work together.

-Adriana B.

Find Us

15 Allstate Pkwy, Suite 683

Markham, ON L3R 5B4

Call/Text

(647) 372-2900

The contents of this site are intended for people in the province of Ontario and British Columbia only. Insurance products are provided through Qualified Financial Services Inc., IDC Worldsource and HUB Financial. Mutual Funds are distributed through Wealthforce Inc.